SUMMARY

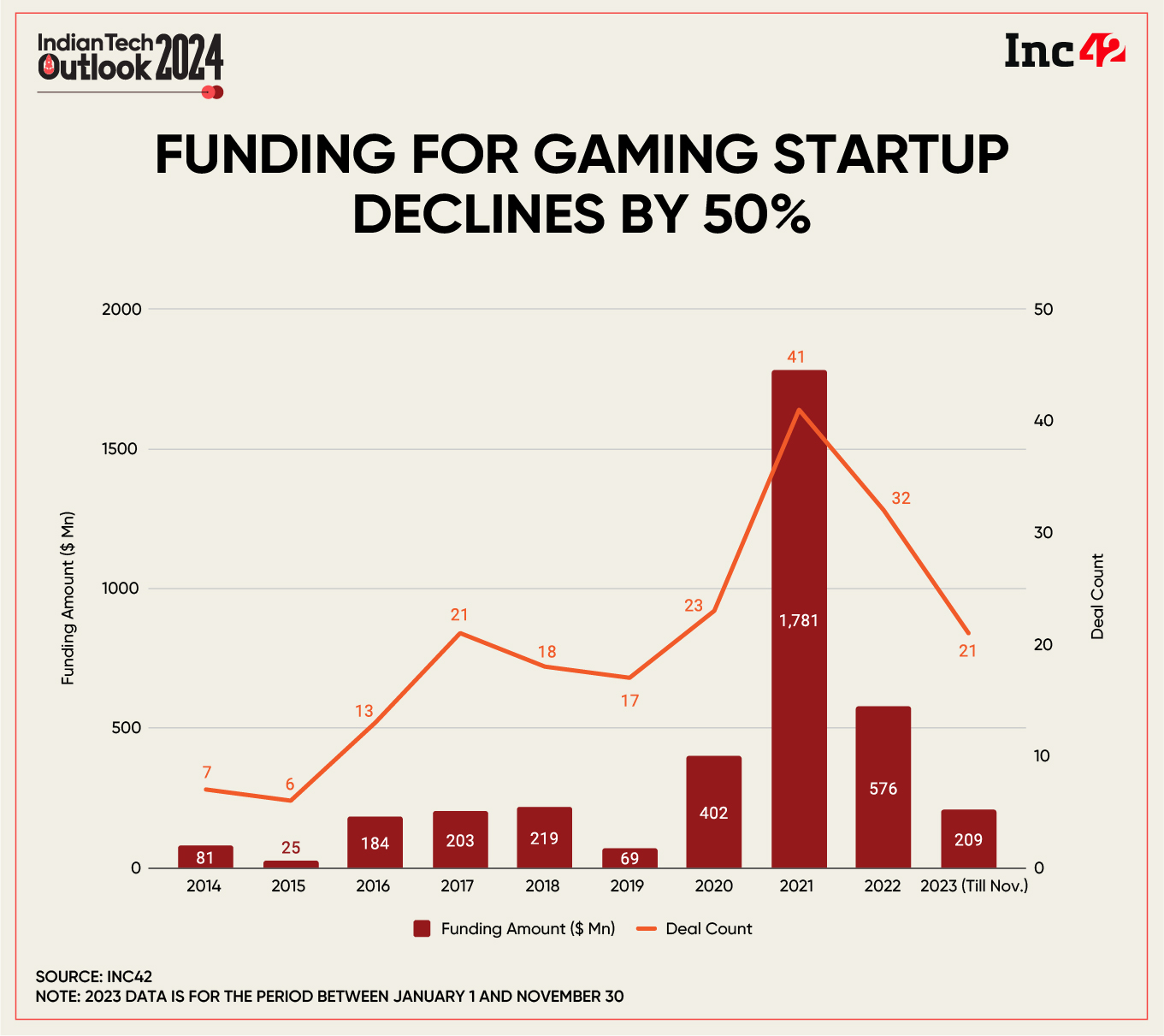

Amid regulatory challenges and taxation impacts faced by RMG firms, funding in the gaming space declined significantly from $576 Mn in 2022 to $209 Mn in 2023 until November

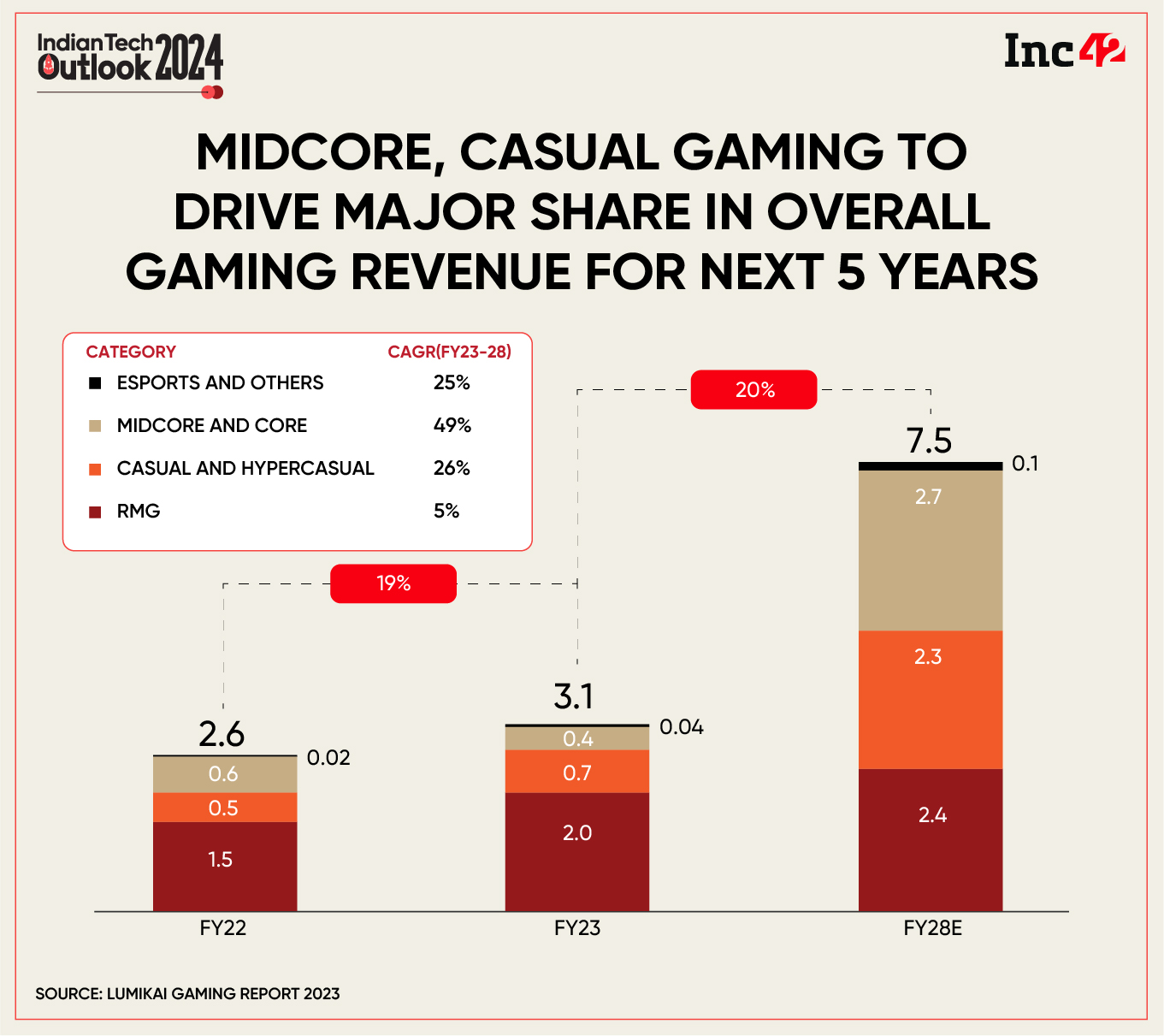

The year 2024 is anticipated to witness springtime for mid-core and casual gaming studios amid expectations of them becoming the primary growth drivers for gaming revenue in India

Even though there are hopes of a stable 2024 on the horizon, investors are expected to remain cautious while setting foot in the gaming realm

The year so far has been no less than a nightmare for gaming players in India. This is because the online gaming industry faced numerous challenges due to the increased regulatory scrutiny and a tightened tax noose on the real money gaming (RMG) segment.

While the Ministry of Electronics and Information Technology (MeitY) provided some clarity by notifying online gaming rules in the first half of the year, the sector was shaken when the GST council mandated a 28% GST.

The move even prompted gaming-focussed VC firm Lumikai to revise its gaming revenue projection for FY28 to $7.5 Bn from $8.6 Bn.

Amid regulatory challenges and taxation impacts faced by RMG firms, funding in the gaming space declined significantly from $576 Mn in 2022 to $209 Mn in 2023 until November, Inc42 data showed.

However, not everything is gloom and doom, even as the overall sentiment for RMG appears subdued.

Well, from predictions point of view, the year 2024 is anticipated to witness springtime for mid-core and casual gaming studios. Investors will be seen tilting towards these segments amid expectations of them becoming the primary growth drivers for gaming revenue in India next year.

Even though there are hopes of a stable 2024 on the horizon, investors are expected to remain cautious while approaching the sector. This caution will likely hurt gaming segments that are sulking due to the government’s tightened GST noose.

With precisely ten days remaining in 2023, let’s understand how experts see this industry going through a shift and the key predictions that will define the Indian online gaming sector in 2024.

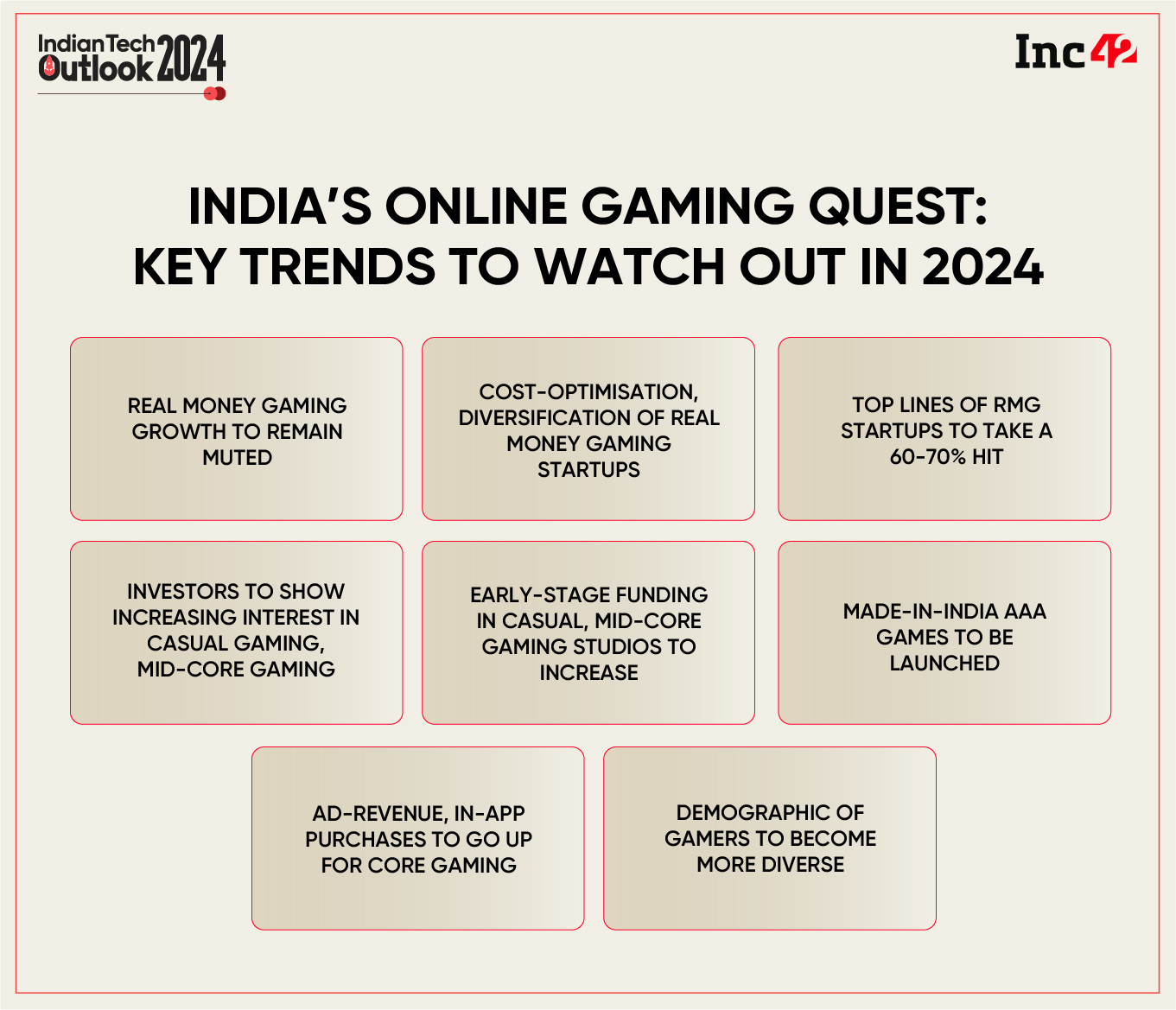

Here Are The 8 Online Gaming Predictions For 2024

No Relief On Cards For RMG Players

As of now, industry experts fear that gaming startups may continue to bear the extra GST cost for the next 1-2 years to retain customers, affecting their topline by about 70-80%. Further, smaller startups with limited funds may face challenges in absorbing the extra costs and could be forced to shut down. Although many smaller RMG startups are considering consolidation, larger startups are presently not showing any interest in acquiring companies within the same segment.

“The tax structure will undoubtedly impact the profitability of RMG companies. Larger VC-funded startups are using their cash reserves to absorb these additional costs. No investments were made in RMG companies during the second half of the year, and I anticipate that new investments are not likely to come in either. It’s just a matter of time that larger startups begin to feel the impact as well,” Sudhir Kamath, chief operating officer of Nazara Technologies, said.

To survive in the current stressful situation, the RMG startups are looking at optimising costs, which will likely have an impact on their innovation in the upcoming year, Kamath added.

Meanwhile, according to a senior executive at an Indian gaming unicorn, larger startups are trying to push diversification such as introducing free-to-play games. However, none of these companies have been able to make significant developments yet.

For instance, Dream Game Studios, owned by Dream11 parent Dream Sports, launched its first mobile game in India and Pakistan in October. Moreover, these companies are also looking to decrease reliance on the Indian market and looking at international expansion. Recently, MPL said its revenue from international operations accounted for 38% of its operating revenue in FY23, up from 11% in FY22.

Casual & Mid-Core Gaming To Change The Game

At a time when investors are shying away from investing in the RMG segment, there is a growing interest in casual and mid-core gaming in India.

Casual games are a category of video games intended for a wide and diverse audience. They are designed to be easily accessible, user-friendly, and enjoyable for players of all skill levels. Some examples of casual games are Candy Crush, Clash of Clans, and puzzle games.

Meanwhile, mid-core games, somewhere between casual and hardcore genres, demand a higher level of player engagement with more complex mechanics and elements, requiring a dedicated time commitment. Free Fire and BGMI are two of the many examples.

While, on the one hand, the return of BGMI (Battlegrounds Mobile India) has reignited advertising interest in the gaming space, in-app purchases for casual games are experiencing growth on the other.

Players are increasingly willing to make in-app purchases for features like skipping wait times, advancing levels, and accelerating progression.

The ease and convenience introduced by UPI have played a significant role in making users more comfortable with in-game transactions.

“I am very bullish on both video gaming and esports. There’s better monetisation potential. We have seen that gamers are now more comfortable paying for in-app purchases and are gradually moving towards big-ticket purchases, thanks to UPI,” Nazara’s Kamath said.

Meanwhile, Ashwin Suresh, the founder of game streaming startup Loco has observed a noticeable willingness to experiment with new genres among gamers.

According to him, until the middle of last year, there was a strong inclination mostly towards shooter games and the battle royale format. “However, as we progressed into the year, we observed a significant uptake in the PC format and a surge in role-playing games and massively multiplayer online games,” Suresh said.

Imperative to mention that the gaming sector is undergoing a demographic shift as well, particularly with the increasing presence of gamers from non-metro cities and towns. Within this demographic, 60% are male and the remaining are female gamers.

Lately, Nazara Technologies is seen focussing on bringing out new games. For this, the listed gaming giant has partnered with four Indian game studios to publish five casual and mid-core games in India.

On an earlier occasion, CEO Nitish Mittersain told Inc42 that Nazara was looking to invest in gaming studios capable of producing top-tier games tailored for both the Indian and global markets.

User Engagement, Retention Rate To Attract Investments

Moving on, according to industry experts, gaming studios can expect to secure anywhere between $3 Mn and $7 Mn from VCs next year.

In the casual gaming segment, investors will likely focus on metrics such as engagement, retention rate, and time spent as they evaluate potential investment opportunities.

Talking about Lumikai’s investment thesis, Salone Sehgal, the general partner of the VC firm said, “We invest in pre-product studios with a focus quality of the team, their previous experience, and the 0-1 scale of their gaming journey. For the studios that have launched one or few games, we focus on engagement, early retention metrics at D-1, D-20, and D-30, along with the time spent on the platform. We also conduct thorough product checks and competitive benchmarking as part of their evaluation process.”

Meanwhile, early stage VC WEH Ventures plans to shift focus from pre-game studios to those that have already launched 2-3 games.

According to Rohit Krishna, partner, WEH Ventures, the overall progress in AI has significantly simplified and made content creation more affordable. Moreover, the availability of new tools will play a crucial role in game development. While many studios have been experimenting this year, they will be seen launching more games next year.

Investors To Remain Cautiously Optimistic About AAA Games

At a time when the future of casual and mid-core gaming studios appears to be bright, investor interest is a bit dim towards AAA gaming. This is because the Indian gaming market predominantly follows a freemium model, and there hasn’t been a significant evolution towards paid-premium games yet. Moreover, Indian studios have not yet successfully developed AAA games.

However, things could change for good as two or three AAA games are scheduled for launch next year. This development is likely to capture the attention of investors and potentially make them more eager to invest in AAA gaming studios.

But, it’s still early days for AAA and console game development in the Indian market as startups are yet to reach that stage of maturity that is needed for this space.

Talking about the maturity in the space, game development startups are taking charge of nurturing next-generation talent. However, this will not be enough for sustainable growth, as these players will have to solve the challenge of high operational costs to subdue the impact of the 28% GST whiplash on the industry.