SUMMARY

There are 4x as many cryptocurrency investors in India as there are equity investors,’ says Joel John, a principal at cryptocurrency investment firm LedgerPrime

People who used to invest in real estate are now investing in the Indian crypto market

In the Global DeFi adoption index, India has been ranked 6th, closely behind China and UK

Indians are now fast moving towards DeFi platforms. In fact, the majority of crypto transactions are now occurring on DeFi platforms, says The 2021 Geography of Cryptocurrency Report by blockchain data firm Chainalysis.

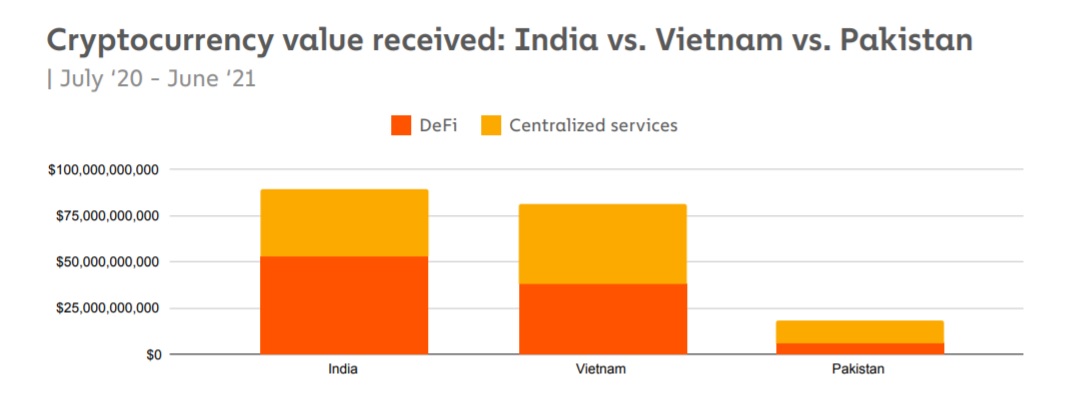

“India has a much bigger share of activity taking place on DeFi platforms at 59%, versus 47% for Vietnam and 33% for Pakistan. All three regions grew substantially over the last year. Pakistan experienced the most growth at 711%, just ahead of India at 641%,” says the report.

Besides the Global crypto adoption index where India ranks two, Chainalysis has also introduced the Global DeFi Adoption index. India has been ranked sixth in this index, closely behind China and UK.

Chainalysis has mapped India as a part of the Central & Southern Asia and Oceania (CSAO) group. And, interestingly, CSAO contains the top three countries in its Global Crypto Adoption Index, with Vietnam at number one, India at two, and Pakistan at three, according to the report.

India Trends: Real Estate Investors Are Now Into Crypto

‘There are 4x as many cryptocurrency investors in India as there are equity investors,’ Joel John, principal, LedgerPrime said.

John further added that one of the reasons behind the fast-growing community of crypto investors is that investing in crypto takes less than an hour. On the other hand, investing in equities in India is a long, painful process that requires one to sign lots of documents and takes about three to four days.

According to John, a number of investors who were investing in real estate are now investing in crypto in India. Also, real estate has gone down in recent years while crypto has been booming, with bitcoin currently trading at $50K+.

The creator economy is fast associating with crypto. Freelance professionals who work for overseas employers request payments in crypto due to both convenience and interest in the asset.

Krishna Sriram, MD at Quantstamp, further specifies the shift in the popularity of crypto — from centralised exchanges to DeFi market. “Centralized exchanges are becoming more stringent and harder to use for people in certain jurisdictions. DeFi doesn’t discern where you’re from or care if it has a relationship with your bank,” he said.