SUMMARY

PhonePe built a war chest in early 2023 and soon after came a flurry of new products that have changed the company considerably

The Bengaluru-based fintech giant has the capital, the key personnel and the burgeoning product line-up to bank on in the super app battle against fellow giants

For PhonePe, 2024 will be about not just proving its thesis around the platform play, but also utilising its deep pockets to grow sustainably and show profits by the end of the year

It’s been a tale of two halves for PhonePe in 2023. But now at the end of the year, it would seem the stage is set for the fintech giant’s biggest onslaught so far.

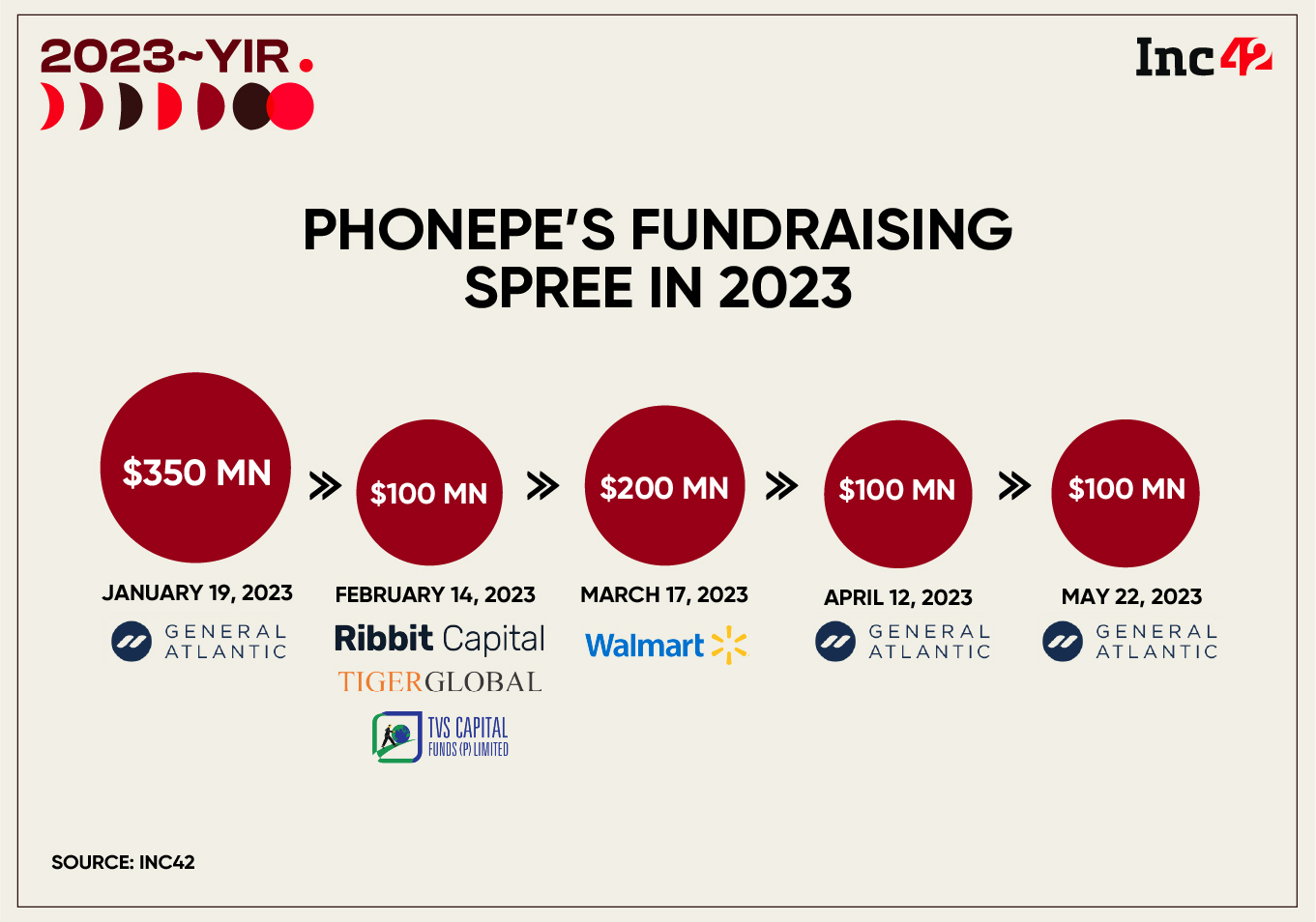

If the first half of the year was all about getting armed for the battle with nearly $1 Bn in funding, the rest of it was about showing what it plans to do with all that money, with several new products ranging from lending to insurance to app development and digital commerce.

But beyond the announcements and the fundraises, PhonePe is perhaps signalling to the Indian tech ecosystem that this is its time.

To put things in context, the company has raised nearly 10% of all funding raised by Indian startups this year. Naturally, there’s a feeling that PhonePe is growing too big to fail, and many compared it to how Walmart gave Flipkart some much-needed impetus in 2017 and 2018 post the acquisition by the US retail giant and subsequently multiple rounds of capital infusion.

“This is what catapulted Flipkart in 2018 towards its current status as the de facto ‘Indian’ ecommerce player, and now it’s PhonePe’s time to grow into its valuation,” a CXO at a Bengaluru-based fintech unicorn told us.

Indeed, it’s hard to escape PhonePe in Bengaluru where it’s the default payments app and its soundboxes and point-of-sale devices are ubiquitous at most small merchants — whether roadside vendors or bakeries.

Such is the dominance of PhonePe in its hometown that spotting a Paytm soundbox or any other rival comes as a surprise. But it would be wrong to think that this is PhonePe’s endgame.

As we have seen throughout this year, PhonePe has much bigger plans. It has the capital, the key personnel and the burgeoning product line-up to bank on. The year has almost come to an end, but PhonePe’s era is just beginning.

With new products in lending, insurance and tax payments on the core PhonePe app, as well as separate apps for ecommerce (Pincode) and investment tech (Share.Market), PhonePe is gearing up in a big way for 2024. Even though some of these products are uncharted territory for PhonePe, it has the resources to succeed in these new areas.

In many ways, 2023 was about setting the stage for this completely new vision. Now as PhonePe prepares for a potential initial public offering (IPO) in 2024-2025, it’s important to understand where the company finds itself at the end of the year.

Recapping PhonePe’s 2023

It all started in late 2022 with the separation from Flipkart and redomiciling to India. This was a critical first step in the plan, which came with a huge tax bill for many of PhonePe’s investors.

The INR 8,000 Cr tax outlay seems like a huge expense, but it was a necessary step to bring PhonePe to India and ensure that the big product plans are not derailed by corporate structures.

Even beyond the tax bill, there was more confidence from investors when they poured millions into the fintech decacorn. The funding spree was led by Walmart, General Atlantic, Ribbit Capital, TVS Capital Funds and others. The plan was to raise $1 Bn, but PhonePe managed to secure $850 Mn.

PhonePe had its war chest ready and soon after came a flurry of new products that have changed the company considerably and given observers a thing or two to ponder upon.

In April, it launched Pincode, an ONDC-integrated digital commerce app, followed by merchant lending services in June. Then came a new point-of-sale device for UPI and cards, income tax payments and health insurance products in July.

In August, we saw the introduction of Share.Market, a separate product for investments and stock broking, and finally the formal launch of the Indus Appstore in September.

Interestingly, with the last of these product launches, PhonePe is not just a fintech app any more. And indeed Indus Appstore holds plenty of potential for PhonePe in the long run.

A New Trump Card: Indus Appstore

In March, we said that PhonePe wants to be Paytm, but that comparison seems off the mark given the launch of Indus Appstore, which promises to be another lucrative long-term revenue stream.

The app store is an alternative to Google Play on Android, and PhonePe’s investment and acquisition was finalised soon after the Competition Commission of India ruled to allow third party app stores on Android devices.

So the more we think about what PhonePe is doing at the end of 2023, the more we wonder whether the Walmart-owned giant is indeed more than a fintech platform.

With 500 Mn lifetime registered users and 37 Mn+ merchants on its platform, PhonePe is poised to press ahead on other fronts besides payment and fintech.

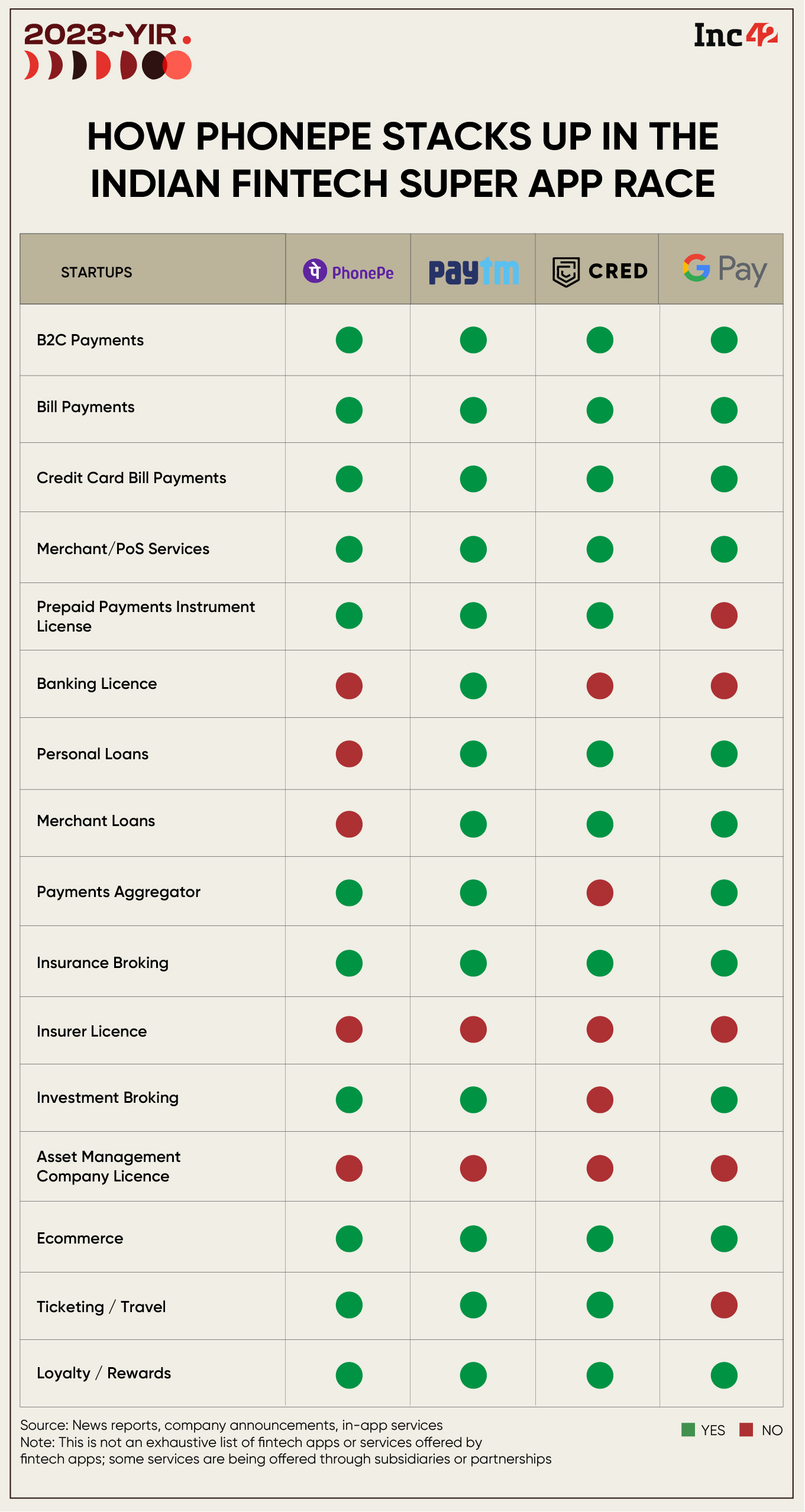

The Indus Appstore product is unmatched by PhonePe’s primary competition such as Paytm, CRED or Groww. While these are also fast building up platform plays around multiple products, PhonePe’s Indus Appstore could be the trump card in the revenue race.

For context, in-app spending is forecast to reach $182 Bn by 2024 and $207 Bn in 2025, according to research firm Sensor Tower. Consumers are said to have spent $132 Bn in 2021, so the projected figures for 2024 represent nearly 40% growth in two years.

Google will get about $10.3 Bn in revenue from app sales and in-app purchases from the Play Store globally in 2023, according to a Time report. In this context, it’s easy to see why PhonePe has invested heavily in an app store. More importantly, Indus does not have Google’s stipulations around commissions and billing policy.

The likes of MPL, Dream11, Nazara, A23, Gameskraft and others have already come on board the Indus Appstore thanks to its zero commission policy. Plus, Indus Appstore is available in 12 Indian languages, which is also expected to be a major competitive advantage against Google and Apple.

While zero commissions have added to the initial attraction for Indus Appstore, PhonePe is likely to add commissions in the future to make this a veritable revenue source.

Both Google and Apple have been hit by antitrust cases in the US and India in relation to their app store policies. It’s the perfect entry point for PhonePe. PhonePe’s marketing machine has also stepped on the accelerator in recent times to show that it has the user base to capitalise.

The PhonePe-Verse

“PhonePe is living up to its name. It wants to be everything on your smartphone, from the app store to financial services to digital commerce and more. The Indian market is fast maturing and this is perhaps the best time for a super app or platform play,” says the founder quoted above.

It is impossible to look at PhonePe’s year, without seeing the similarities with the competition that is on a comparable scale. The super app movement or the convergence of financial services is a clear theme emerging in 2023.

For several years, it was believed that Indian apps could replicate the success of super apps such as WeChat, Grab or Gojek in China and Southeast Asia.

But while the likes of Paytm tried this in the past, the strategy did not succeed fully due to a lack of market depth and consumer maturity. Even as late as 2021, Paytm bemoaned the fact that the platform model was not well understood by retail investors.

But times have changed and now the Indian market is looking like a better bet for super app players. Let’s look at two key pieces in PhonePe’s armoury in this battle — ecommerce and investment tech.

ONDC’s New Wings

Built on ONDC, the Pincode app was launched in Bengaluru in April where it has already delivered over 1 Lakh orders as of July 2023, and PhonePe has expanded to Delhi NCR, Mumbai, Chennai, Hyderabad, and Pune, among other cities.

ONDC has become the crutch for non-ecommerce players to scale up their digital commerce footprint quickly.

Take for instance, Paytm Mall, which was once a unicorn, but has faded into the background in comparison to marketplace giants Flipkart and Amazon India. Today, Paytm’s digital commerce business also hinges on ONDC, just like PhonePe’s Pincode.

CRED is relying on a highly curated marketplace approach, while Google Pay is playing the aggregator game. PhonePe’s dedicated app is an interesting approach in this space and unlike any other player in the super app race.

A company spokesperson told us, “The initial response and rapid consumer adoption of Pincode has given us the confidence to expand our services. We are fully committed to championing local sellers and delivering an exceptional shopping experience to our consumers.”

The company added that it will be investing heavily to expand to more cities and into more categories, including medicines, fashion, and electronics to become a full-fledged ecommerce app.

Entering The Investment Fray

The other big piece of the puzzle is Share.Market, which PhonePe has sequestered from its core business as is standard practice. Even though it’s a separate app with a stockbroking licence, Share.Market’s revenue growth will be a key contributor to PhonePe’s business in the long run.

The revenue model for stock broking is relatively straightforward as platforms take a cut on trades and transactions. With the right scale, profitability is not a long shot either.

Fellow Bengaluru fintech unicorn Groww reached profitability in FY23 thanks to its growing user base and today has more than 6.63 Mn+ active investors.

This makes the company the biggest discount brokerage by clients in India. PhonePe would be betting that its existing user base of 200 Mn+ monthly active users can help it leapfrog Groww, Zerodha and others.

At the scale that PhonePe operates on, even an incremental increase in the volume means tens of millions more revenue-generating transactions. For instance, Paytm Money turned profitable in FY23, posting a net profit of INR 42.8 Cr and bounced back from a loss of INR 10.7 Cr in FY22, helped by steadily growing brokerage income.

In a statement, a PhonePe spokesperson added that in the past two years, the company has seen a huge increase in adoption from Tier III and IV cities and beyond when it comes to payments and other in-app services.

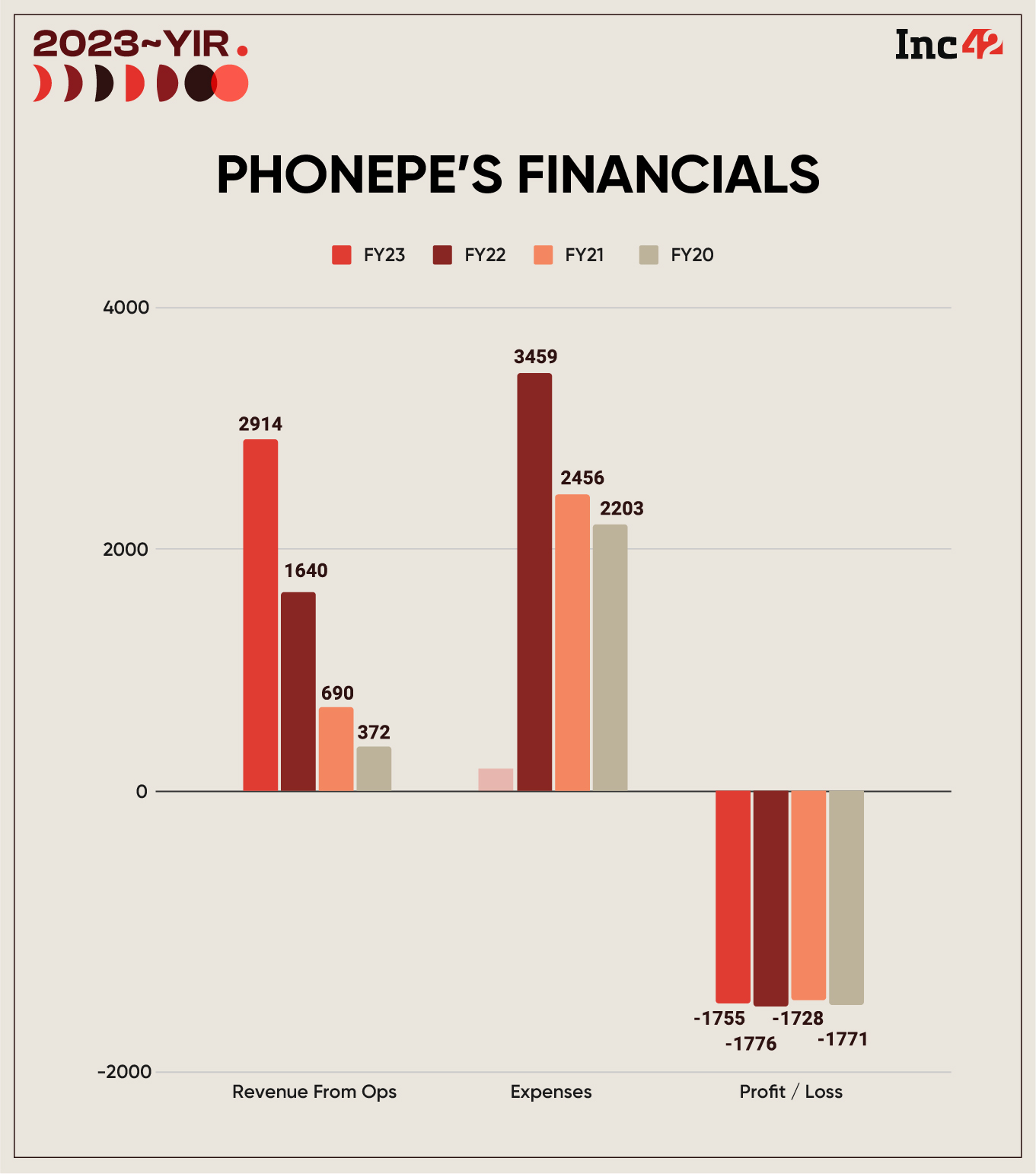

And now is the time to press the accelerator on other products that are tied into the payments core. PhonePe said it registered INR 2,914 Cr as revenue on a consolidated basis in FY23, but the company did not reveal whether it has managed to bring its losses down from the INR 2,013 Cr it reported in FY22.

What we do know is that PhonePe has reached a $1.3 Bn in lifetime total payments value, according to Walmart CFO John David Rainey. Will this translate into profits in the next year?

Where Will PhonePe Go In 2024?

Revenue from the investment tech business will likely contribute in a major way towards bringing the consolidated business towards the black. But other parts of the PhonePe empire will also be key to getting out of the loss-making streak.

It’s interesting that the new products at PhonePe are grabbing a lot of the interest internally from the company, but let’s not forget that PhonePe’s fintech services primarily hold the key for the turnaround.

Merchant services — lending and device subscription — is likely to be a crucial piece. PhonePe is gearing up to roll out consumer lending services on its platform by January next year. Marking its foray into the consumer lending space, Walmart-backed company is likely to operate initially as a distributor for personal loans.

“The Indian market has seen a lot of maturity in 2023. The most active and habituated fintech customers have become familiar with digital-first financial services, and we believe the opportunity is rich for platforms to accelerate the process of unlocking the flow of money and access to services,” the company spokesperson said.

PhonePe’s trajectory is very similar to Paytm, even if there are many differences in strategy. The scale of both companies is similar in terms of the users, and they have got the market timing right on a number of new products. But Paytm is still a long way away from PhonePe in terms of revenue — INR 7,990 Cr for the listed giant vs INR 2,914 Cr for PhonePe.

For PhonePe, 2024 will be about not just proving its thesis around the platform play, but also utilising its deep pockets to grow sustainably and show profits by the end of the year. This is a critical juncture for the company.

Several startups seemed to have cracked the profitability question in FY23 and many of them did not have the luxury of having raised $850 Mn in the year. PhonePe is like royalty in that sense, but even empires face pressure eventually, even when they have a large war chest.

Funding is not a guarantee of success. PhonePe has the right tools and the stage is set, can the fintech giant make something of it in 2024?