SUMMARY

In the bigger picture, market cycles come and go; there are credible reasons to believe this is India’s decade of tech

It’s time to step back and look at the big picture. Through everyday coverage of the startup and tech economy we are inundated with narratives of things going wrong — which they have — and the sorry situation at some of the most storied startups.

Indeed, things have not gone well for the likes of BYJU’S, PharmEasy and others in recent times. Edtech is suffering from a spate of shutdowns, layoffs continue, markdowns are here in spades and a lot more. But bumps are temporary and cycles come and go. We wanted to take a broader view on what’s being called India’s decade of tech.

The fact that it’s coinciding with a major geopolitical shift cannot be ignored. There’s good reason to believe that this is really India’s decade of tech. We’ll delve into those after these top stories from our newsroom this week:

- 4 Days To MoneyX: India’s largest conclave for angel investors and VCs is almost here. Join us at MoneyX with 400 thought leaders from the world of PEs, venture funds, family offices, corporate funds and the wider startup investor ecosystem.

- Zepto To End Unicorn Drought? The Indian startup ecosystem is about to welcome its first unicorn of 2023 with quick commerce startup Zepto currently in talks to raise $150 Mn at a valuation of $1.3 Bn

- Dunzo Loses ‘It’ Factor: In the face of monumental competition from the likes of Zepto, Blinkit and Swiggy, Dunzo has lost its quick commerce mojo and is going back to its hyperlocal biz. Here’s what went wrong.

Why This Is India’s Tech Decade

There are three major factors that are in India’s favour: global tech diplomacy has India at its centre currently, digital infrastructure and public goods are driving new adoption and the startup ecosystem has learnt some bitter lessons in the past year.

Each of these is a key pillar in India’s goal of becoming a $1 Tn digital economy by 2025, from the earlier 2030 goal. But they are also interlinked in many ways.

Diplomacy Through Tech: India’s Latest Strategy

India is home to the third largest startup ecosystem in the world, but there’s little doubt that the global tech ecosystem is driven by US tech giants and large corporations that drive most top-level innovation.

In the case of AI, for instance, the likes of Microsoft, Google, OpenAI, Nvidia, Adobe and others have taken the early lead. Similarly, private sector involvement in aerospace and drone tech development in the US is potentially a few years ahead of India. But recent decisions from Prime Minister Narendra Modi’s visit to the US could potentially unlock greater cooperation.

India and the US will work together on a next-gen interoperable telecom network for the 6G era, and collaborative research in quantum computing. This could have far-reaching implications for encryption, cryptography, aerospace engineering, 3D modelling and other areas.

Both countries also signed a deal to spur research on quantum, AI, and advanced wireless technologies. Further, the India-US Defence Acceleration Ecosystem or INDUS-X is expected to create a network of universities, incubators, corporate, think tanks, and private investment stakeholders.

Of course, we have seen such partnerships and agreements being announced in the past as well, and there’s usually a lag between announcement and execution due to cross-border red tape. This time around, there’s more certainty of India playing a bigger role. A lot of this also has to do with prevailing geopolitical conditions, but the fact that India’s tech economy is in a maturity phase has also come as a blessing in disguise.

From a macroeconomic perspective, for instance, India’s tech economy is said to have avoided the worst of the slowdown of the past year. In June, the World Bank put India’s GDP growth for FY24 at 6.3%, well ahead of the global growth rate which is projected to decelerate from 3.1% in 2022 to 2.1% in 2023.

India’s journey from a services giant to a product-led tech economy has already given it some advantages, and now these global collaborations could lay the foundation for the future.

VCs believe that the momentum is with the country, when you look at the global macroeconomic factors and how severely China and the US have been impacted. India is relatively better off in that sense.

India saw 3X the number of unicorns as China in 2022, and according to a Startup Genome, Indian startup hubs outshone their Chinese counterparts — Bengaluru, Delhi and Mumbai moved up in the rankings at the expense of Beijing and Shanghai.

Other investors pointed to the favourable global environment where India is seen as a veritable challenger to China. The so-called ‘China + One’ movement gives India a unique opportunity to grow its tech muscle and create jobs in manufacturing and core technology industries. Now the ball is in the courts of the tech industry and startups to live up to these expectations.

Startups Chart New Growth Course

Nevertheless, the global macroeconomic slowdown has trickled down to startups in the form of a funding winter and downturn for B2C and B2B startups due to cutbacks in discretionary and business spending.

Despite the pain for their portfolio, VCs and fund managers believe the correction in valuations, the cautious deal-making and the focus on sustainable growth necessitated by market forces could be a blessing in disguise. Of course, a lot of VCs have also curbed their growth expectations which led to this untenable situation.

Earlier, Elevation Capital’s Mayank Khanduja told Inc42 that founders have realised the need to figure out monetisation early on in the business lifecycle. “And as the country grows, tech businesses will capture a disproportionate share of the incremental market share and market cap being created. Thus we believe India will see many more $5 Bn-$10 Bn companies coming out over the next 10 years.” he added.

With valuations being more reasonable, investors believe that founder resilience and mindset are becoming highly differentiated propositions. The mindset change has also made investors bullish about future startups.

As per Inc42’s projections, India will be home to 1.84 Lakh+ startups by 2030 up from around 65,000+ startups today. There’s a mine of dry powder sitting with investors, waiting to be unleashed as India races to become a $5 Tn economy by 2030.

Many of these startups will look to capture the global opportunity that emerges with the growth of segments such as AI and data engineering.

Untapped Potential Waiting In The Wings

The bull case for India is particularly strong from a macro point of view. The headroom for growth is unprecedented in the modern world.

Nielsen’s India Internet Report 2023 noted that India’s rural economy holds immense potential for growth as more than a billion Indians still don’t actively use modern devices even if they may be active internet users — out of the 1.4 Bn population, just about 450 Mn people owned smartphones in the country in 2022.

The base of transacting users is expected to grow significantly along with the per capita GDP over the next five-six years.

“What’s happening in India with digital public goods is phenomenal. It’s just unbelievable for me to see India stack mature and use cases between the technology and the policy. There’s nothing like that I see anywhere else in the world… It has 100% global applicability,” Microsoft’s chairman and chief executive officer (CEO) Satya Nadella said in January this year.

India Stack and digital public goods infrastructure has become a key part of India’s global tech diplomacy. Along with UPI, the introduction of Account Aggregators, Open Credit Enablement Network (OCEN) and Open Network For Digital Commerce (ONDC) has more or less created a comprehensive stack on which businesses can build for all of India., and quite possibly the world.

UPI is perhaps the best known of the India Stack and has already gone live in Singapore, UAE, Canada and now France, among other countries. Indeed, major tech giants such as Google are looking at UPI as a blueprint for building global plays.

Domestic Investors Join The Pool

The next phase will need more domestic investors driving these innovations. From SoftBank to Tiger Global to Sequoia to Accel and others — we know that it is foreign capital that has unlocked a world of startups in India.

Today, domestic capital contributes less than 10% of the total capital invested in Indian startups. The big hope for India is that as the startup asset class becomes a point of diversification for family offices, corporate venture capital and HNIs, this is expected to grow significantly over the next few years.

One cannot understate the power of domestic money fuelling innovation in the country as seen in the case of Silicon Valley in the late 90s and early 2000s. While public markets have been embraced by non-institutional wealth, tech startups are a new asset class and only now as investors are realising the upside of backing startups.

Out of the 9,500+ unique investors recorded by Inc42 in 2022, the largest share was taken by 5,120+ angel investors (53%) who are part of the growing domestic investor pool. By 2030, we project that India will have more than 18K investors, with angels and family offices driving this growth.

But there’s a lot of groundwork to be done to bring these aspiring investors to the fold.

In a bid to help unlock this large pool of domestic capital for Indian startups, we decided to host MoneyX. Just four days away and scheduled for July 20, MoneyX by Inc42 is a gateway for investors looking to tap into India’s massive startup potential.

The MoneyX conclave is here to create the right awareness about startups as an asset class and bring access to the existing investor network.

Join us at MoneyX and get a glimpse of what India holds in store for investors and the tech ecosystem, with luminaries such as Amitabh Kant, India’s G20 Sherpa and former CEO of NITI Aayog, Sanjeev Bikhchandani of Info Edge; Gopal Srinivasan of TVS Capital Funds; Soumya Rajan of Waterfield Advisors, Dipesh Shah of GIFT City among others.

Bringing together nearly 300 of the most active VCs, PE investors, angels, family offices, and corporate venture funds, MoneyX is looking to unlock the future of startup investments and domestic capital in India.

Sunday Roundup: Funding Tracker, Tech Stocks & More

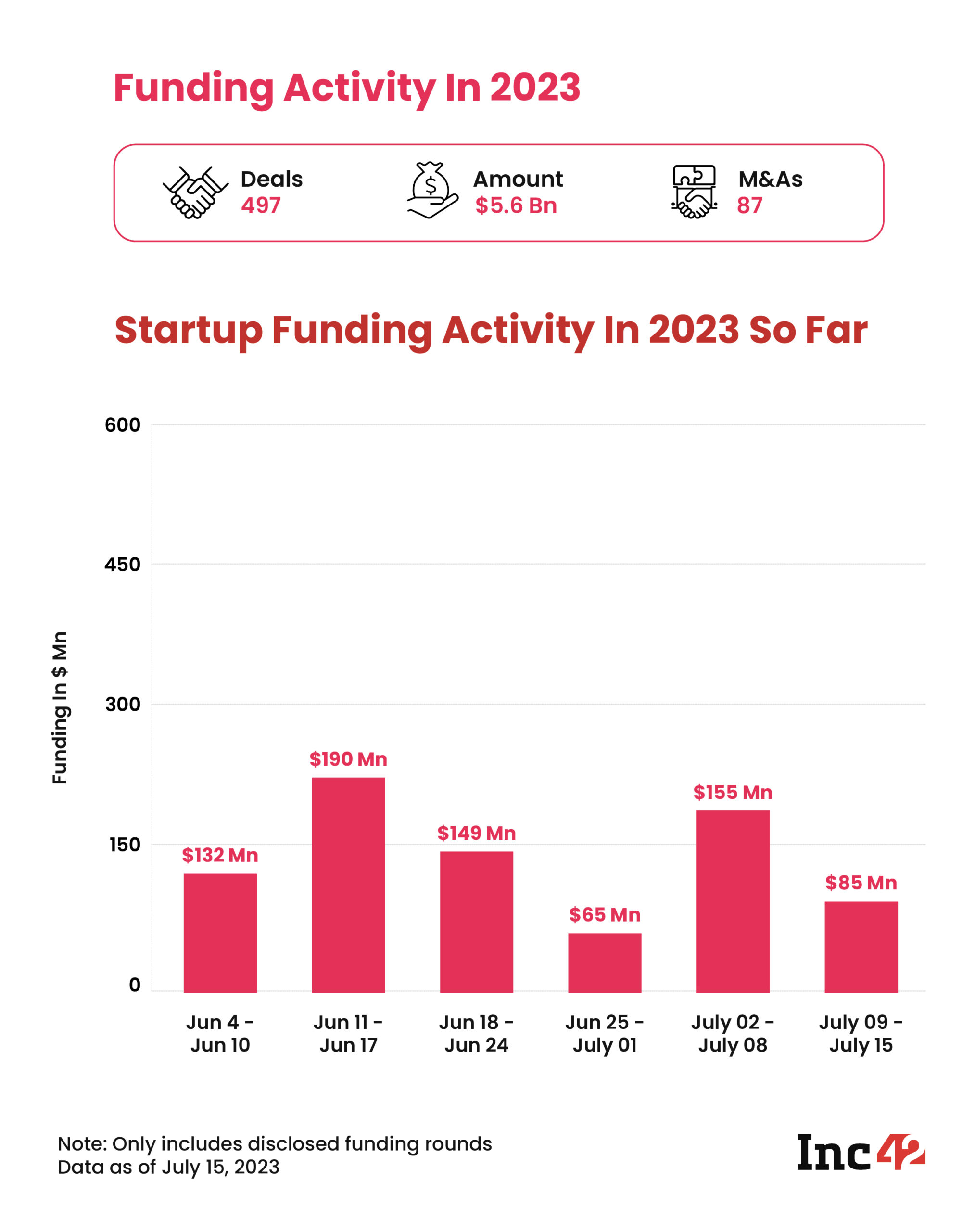

- Startup Funding This Week: After a minor bump, startup funding has fallen to under $100 Mn for the week. With 17 deals recorded, Indian startups only raised $85.4 Mn over the past seven days.

- CRED’s UPI Run: Fintech unicorn CRED has seemingly made fast inroads into the UPI space, claiming the fourth spot for the second month for transactions

- Flipkart’s Millionaires: As part of the demerger from PhonePe, Flipkart has started paying cash compensation worth $700 Mn to its employees in the largest exercise of its kind among Indian startups

- GST Blues For Gaming: With 28% GST set for online gaming, startups and listed companies are in panic mode and many wonder whether this will be a death knell for the industry

- FrontRow Shuttered: Deepika Padukone-backed FrontRow, which was looking for an acquisition earlier after mass layoffs, shut its operations in mid-June

- More Protests At Urban Company: Gig worker troubles at Urban Company refuse to end, as the startup was hit by fresh protests from service partners this past week